Weather in Downtown Miami

Climate as a key variable in real estate investment in Downtown Miami

Beyond the Sunshine: How the Tropical Weather Impacts Your Investment

When it comes to investing in Downtown Miami, one of the most relevant — and often underestimated — factors is the city’s tropical climate. This warm, humid, and sunny environment throughout most of the year not only enhances the quality of life for residents but also directly influences real estate profitability.

Thanks to its favorable climate, Miami maintains high demand year-round, especially in the short-term rental market. Tourists and seasonal professionals look for well-located properties in areas such as Downtown, ensuring consistent occupancy rates.

However, the climate also presents challenges that investors must consider — including the cost of hurricane insurance, periods of intensive maintenance, and proper property preparation for heavy rain or tropical storms.

Investing wisely means anticipating these variables. Properties that are well-adapted to the climatic environment not only preserve their value better but also offer higher returns over time.

Miami’s Climate Dynamics: What Every Investor Should Know

Dry and Rainy Seasons: How They Shift and the Costs Involved

Understanding Miami’s climate is essential for making smarter investment decisions. The city is divided into two distinct seasons: the dry season, which runs from November to April, and the rainy season, from May to October. Both have a significant impact on real estate market behavior, rental demand, and property operating costs.

During the dry season, the weather is cooler, sunnier, and more stable — attracting tourists, digital nomads, and temporary residents. It’s the period of highest occupancy and demand, making it ideal for those investing in short-term rentals.

In contrast, the rainy season brings higher humidity, frequent storms, and potential cyclones, which can increase maintenance and insurance expenses. It also requires preventive and preparedness strategies for buildings and apartments, especially in Downtown Miami, where urban density demands efficient management.

Understanding this dynamic not only improves profitability but also allows for more accurate investment planning.

Economic and Social Effects of Climate on the Real Estate Market

Price Adjustments Due to Seasonality and Extreme Weather

Miami’s tropical climate creates a marked seasonality that directly impacts property prices, rental returns, and property appreciation, especially in areas exposed to climatic phenomena. During the dry months, prices tend to rise due to increased tourist and corporate demand, while in the rainy season, adjustments and greater sensitivity to extreme weather risks, such as hurricanes, can be observed.

In addition, the market has changed since the pandemic. Many buyers have adopted a more analytical approach, evaluating not only the location and design of properties but also their resilience to the climate. This new behavior has slowed certain segments but has also strengthened well-prepared areas such as Downtown Miami. You can learn more about this structural change in this real estate market analysis.

Tropical Climate and Migration: South Florida’s Appeal for Foreign Investors

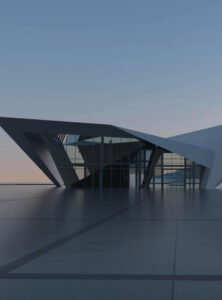

Downtown Miami Facing the Climate: Strategic Investment Advantages

Modern Infrastructure, Height, and Adaptation to Climate Risks

Strategic Location: Accessibility, Year-Round Demand, and Audience Diversification

Downtown’s location is another key factor: direct connectivity to the airport, a free Metromover, the Brightline train line to the north of the state, and proximity to key areas such as Brickell and Wynwood. This infrastructure allows for stable demand throughout the year, with a constant flow of tourists, residents, and professionals.

In addition, its mixed profile — corporate, cultural, and residential — enables the diversification of audiences and rental strategies, minimizing seasonality and increasing return on investment.

Investing in Downtown Miami with Climate and Market Intelligence

Understanding the Climate Is Key to Making Safer, and More Profitable Decisions

In today’s context, investing without considering climatic conditions means leaving a critical factor out of the equation. Downtown Miami has become a model of how climate awareness can guide safer, more sustainable, and profitable investments. Its strategic location, combined with modern infrastructure adapted to climate challenges, offers real advantages compared to other areas of the city.

By understanding seasonality cycles, hurricane-related risks, and the advantages of the tropical climate during winter, investors can optimize their strategy: from acquiring properties with higher appreciation potential to choosing the ideal time to rent or sell.

Additionally, Downtown offers a perfect balance between climatic appeal and commercial performance. Its connection to cultural, financial, and transportation hubs keeps it in high demand year-round, regardless of the season. This stability positions it as one of the smartest areas to invest in South Florida.

Investing with climate intelligence is not just a trend—it’s a necessity. And Downtown Miami provides the ideal context to do so with a long-term vision. For more information, contact one of our experts.