Tax Benefits of Investing in Miami Real Estate

Investing in Miami Properties with Tax Intelligence

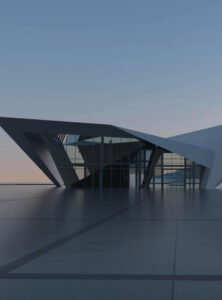

Urban Growth and Tax Benefits: The Ideal Combination for Investment

Miami has established itself as one of the most attractive destinations for international real estate investors, not only due to its rapid urban development but also because of its highly favorable tax framework. Unlike other global markets, Miami does not impose state taxes on personal income, resulting in higher net returns for those investing in properties.

The city’s investor-friendly environment, combined with its world-class infrastructure, prime climate, and high rental demand, has made Miami a key destination for those looking to grow their wealth with a long-term vision. However, what can truly make the difference between an average investment and a highly profitable one is understanding and strategically applying the available tax advantages.

From the correct property structure to optimizing deductible expenses, investing with tax intelligence can maximize returns and protect your capital.

Depreciation: A Strategic Tool to Reduce Taxes

Annual Deduction That Improves the Profitability of Your Investment

One of the most powerful tax advantages when investing in properties in Miami is depreciation. This accounting concept allows you to annually deduct a portion of your property’s construction value, as if it “lost” value over time, even though in practice its market price may be increasing. In other words, you can generate a tax deduction even while your investment is appreciating.

This strategy is especially useful for investors who rent out their properties, as it legally reduces the taxable base of rental income. By applying depreciation correctly, the tax impact is minimized year after year, resulting in higher net returns without affecting the real value of the asset.

Understanding and applying this benefit properly is key to investing wisely in the competitive real estate market of Miami.

Mortgage Interest Deduction: Real Savings on Financing

A Key Benefit for Investors Using Financing

When investing in real estate in Miami using financing, one of the most relevant tax benefits is the mortgage interest deduction. This incentive allows you to subtract the interest paid on your mortgage loan from your taxable gross income, directly reducing your tax burden and improving the net profitability of your investment.

This benefit is especially significant during the early years of the loan, when monthly payments are mostly composed of interest. Taking full advantage of this deduction efficiently can result in substantial savings year after year.

To maximize this advantage, it is essential to keep a detailed and organized record of all mortgage payments. Having proper documentation makes tax filing easier and ensures that you can claim the full deduction without complications with the IRS.

If you are planning to finance your investment in Miami, consider this benefit as a strategic tool. It not only reduces your taxes but also improves the cash flow available for reinvesting or maintaining the property.

This type of deduction makes financing an even more attractive option for those looking to build wealth with tax-smart strategies.

Operating Expenses: Every Cost Related Can Be a Deduction

Every dollar you invest in operating your property can return tax benefits

One of the major tax advantages of investing in properties in Miami is the ability to deduct a wide variety of operating expenses. These include costs necessary to maintain and manage the property, which helps reduce the tax burden and improve net profitability.

Deductible expenses include routine maintenance, minor repairs, property insurance, utilities (such as water, electricity, internet), property management fees, legal fees, and even marketing costs for rentals. All of these can be applied as deductions on your tax return, provided they are properly documented.

To make the most of this benefit, it is essential to keep clear and organized accounting. Keeping receipts, invoices, and financial reports up to date not only simplifies tax filing but also protects the investor in case of any IRS audit or review.

Every dollar you invest in operating your property not only preserves its value and functionality but can also represent a direct tax saving. Investing with vision also means managing with precision.

Capital Gains: Benefits from Property Sales

Reduced Long-Term Capital Gains Rates

Selling a property in Miami can be an opportunity not only to capitalize on value appreciation but also to take advantage of significant tax benefits. If you hold your investment for more than one year, the profits qualify as long-term capital gains, which are taxed at significantly lower rates than ordinary income. This savings can amount to thousands of dollars compared to a short-term sale.

Investing with vision also means planning for the exit. With a well-thought-out strategy, you can optimize benefits not only during ownership but also at the time of sale.

1031 Exchange: Legally Deferring Taxes

A powerful tool for investors is the 1031 Exchange, which allows reinvesting the proceeds from a sale into another like-kind property without paying taxes immediately. This legal mechanism does not eliminate the tax obligation but defers it, enabling you to reinvest 100% of your capital and continue growing your portfolio without depleting funds.

To execute this strategy correctly and comply with IRS deadlines and requirements, it is essential to have specialized tax guidance. Used intelligently, the 1031 Exchange is key to building real estate wealth in a sustainable and efficient manner.

Primary Residence Exemption: Personalized Savings for Homeowners

A Key Tax Benefit For Those Living In Their Property

If you are considering selling your primary residence in Miami, it is essential to know one of the most important tax benefits available to homeowners: the Primary Residence Exemption. This exemption allows you to exclude up to $250,000 in capital gains if selling as an individual, or up to $500,000 if selling as a couple, provided certain basic requirements are met.

The main requirement is that you have lived in the property for at least two of the last five years before the sale. These years do not have to be consecutive, offering greater flexibility for the homeowner. This strategy allows you to retain most of the profits generated by the property’s appreciation without paying federal taxes on them.

This type of benefit can make a significant financial difference when planning the sale of a residential property. Additionally, combining this exemption with other tax strategies—such as timing the sale correctly or reinvesting—can maximize the capital available for future investments.

Living in your property not only represents quality of life but also provides a significant tax advantage when selling wisely.

Unique State Tax Benefits in Florida

Zero State Income Tax: A Magnet for Investors

One of the key reasons so many investors choose Miami and other Florida cities is the complete absence of state personal income tax. Unlike states such as California, New York, or Illinois, where personal income taxes can exceed 10%, in Florida that rate is zero. This allows investors to retain a larger portion of their profits, optimizing the real return on each real estate transaction.

Incentives for Businesses and Commercial Properties

Florida also offers a highly competitive tax environment for businesses and commercial investments. There is no tax on intangible personal property, no corporate franchise tax, and no taxes on commercial inventory. This structure applies to both individuals and legal entities, making it an ideal option for those looking to establish companies, investment funds, or real estate holdings in the state.

Investing in Florida is not only a strategic decision because of its real estate market but also because of its exceptionally favorable tax ecosystem.

Favorable Economic and Legal Impact for Investors

Resilient and Growing Economy

Florida has established itself as one of the strongest and most dynamic states economically within the United States. In 2023, its Gross Domestic Product grew by 9.3%, far surpassing the national average and positioning it as the 15th largest economy in the world, according to data from the Florida Chamber of Commerce.

This growth is driven by high internal migration, the arrival of new businesses, and public policies focused on economic development. For investors, this translates into stability, sustained demand, and an ideal environment to capitalize on real estate opportunities.

Pro-Investor Legal Environment

Florida also stands out for offering a legal framework favorable to investment, especially attractive for foreign buyers and companies seeking to relocate. Its flexible legislation allows for better tax planning, efficient corporate structures, and greater asset protection.

This legal and economic environment makes Florida an ideal destination not only for investing but also for establishing a secure and profitable long-term wealth-building strategy.

Plan Your Investment with Vision and Tax Advantage

Make the Most of Every Advantage to Invest Wisely

Investing in real estate in Miami is not just a property decision—it is a comprehensive financial strategy. Throughout this article, we have explored how to optimize that investment through key tax benefits: from annual depreciation, which allows deductions even as the asset appreciates, to the mortgage interest deduction, which improves net profitability.

We also reviewed the importance of managing operating expenses, the impact of the 1031 Exchange for deferring taxes, and the Primary Residence Exemption, which allows the exclusion of capital gains on qualifying sales. Additionally, we highlighted Florida’s unique tax incentives, such as the absence of state income tax and additional benefits for businesses and commercial properties.

All of this takes place within a favorable economic context and a pro-investor legal environment, making Florida one of the strongest and most attractive destinations for those seeking sustainable wealth growth. Contact one of our experts for more information.